Dubai As A Global Business Hub

Dubai has rapidly become one of the world’s most attractive destinations for entrepreneurs, investors, and multinational companies. According to the Dubai Chamber of Commerce, over 70,000 new companies were registered in 2024, displaying a 3% growth from 2023. Also, the Dubai International Chamber reported 58% of multinational company investments in the first half of 2025 came from Asia, followed by 16.1% from Europe. This notable increase sparks positive attraction from foreign investors as Dubai’s business environment highlights a strong corporate governance.

With such momentum, it’s clear: the UAE is thriving as a global business hub.

But before launching your business idea, it’s important to understand the key business terms you’ll encounter throughout the setup process. Because knowing the terminology can help you make smarter decisions when you make the ultimate move.

Mainland Company

Mainland companies are established across the UAE mainland and are free to operate in a range of sectors within the region. Most activities can now be 100% foreign ownership eligible, but some require an Emirati partner, depending on the business type.

To set up a mainland company, investors should secure a trade license and physical office space. Some of the benefits of setting up a mainland company are tax exemption on corporate and income tax and a database of highly talented and well-educated professionals.

Free Zone Company

Free zone companies are formed in designated areas for specific business activities. These companies can do transactions within the free zone and internationally. However, they are not allowed to directly conduct business in the UAE market without a local distributor.

To set up a free zone company, each zone is managed by its own authority, so business owners can select their zone based on business goals and needs. One significant factor in the free zone is the flexibility in office solutions. Free zone companies have options for offices, such as shared offices, flexi-desks, and virtual spaces, which are ideal for start-up and small businesses.

Offshore Company

Offshore companies are corporate entities that are created outside of Dubai and the rest of the UAE but register with UAE authorities to conduct business within the region.

To set up an offshore company, investors will choose their jurisdictions. In the UAE, key areas are the Ras Al Khaimah International Corporate Center (RAK ICC), Jebel Ali Free Zone (JAFZA), and Abu Dhabi Global Market (ADGM).

Similarly to mainland and free zone set-ups, offshore company licensing and document submissions are mandatory, so choosing a business consultant will fast-track the entire registration process. Sarsan Corporate Services offers tailored-fit solutions for different business setups. They have a dedicated team to ensure a seamless setup experience for each business, such as a comprehensive business structure of licensing and visa processing in the UAE and transparent and competitive pricing for your financial commitment.

Residency Visa

Foreigners apply for a residence visa in order to stay in Dubai for a long-term. Individuals who are working for private companies or government entities, students, universities and schools, and investors in properties and businesses in Dubai are all eligible to apply for a Dubai residency visa.

Golden Visa

Golden visa is a long-term residency visa without sponsorship. This visa is given to real estate investors, entrepreneurs, and outstanding talents in different fields, such as doctors, scientists, inventors, executives, athletes, PhD holders, etc. Once all terms, conditions, and procedures are met, they can live in Dubai for up to ten years and their visa is automatically renewed.

Dependent Visa

Employees and individuals in Dubai can sponsor their families to reside here which fall under the dependent visa. Spouses, children, and parents are eligible for this type of visa. In order to acquire this, the sponsor has to secure proof of financial self-sufficiency, proof of adequate housing, and private health insurance.

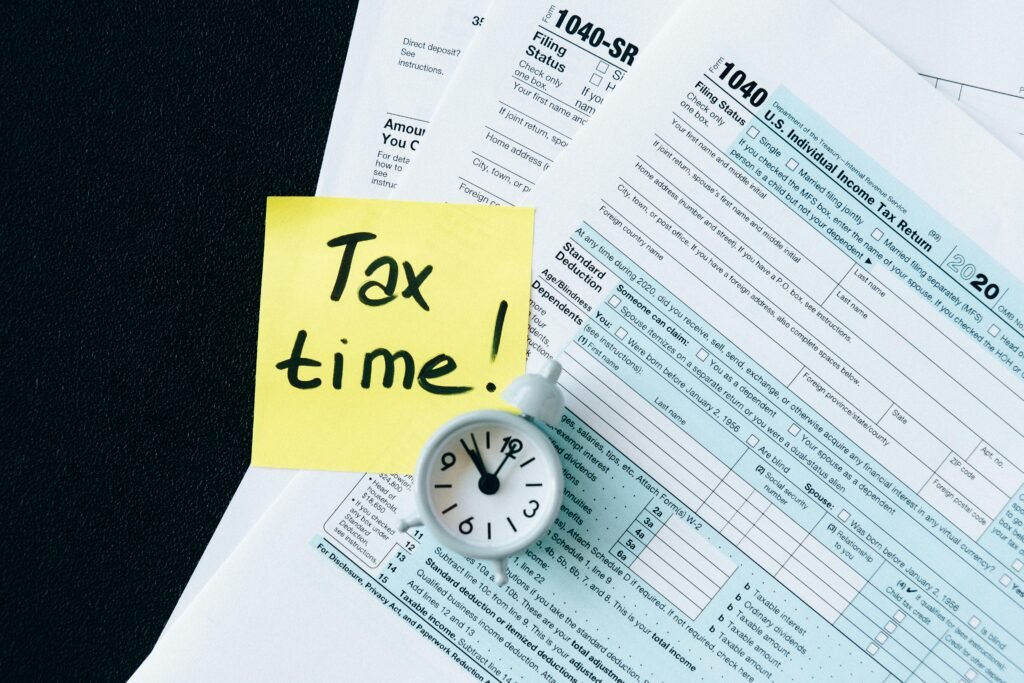

Cross-country Taxation

To be able to do business internationally, tax regulations and principles apply to the business. It is important to apply this because it will avoid double taxation and financial struggles. Some of the key elements are transfer pricing and permanent establishment.

Conclusion

These are some of the key terms you will need to familiarize yourself with when you’re starting a business in Dubai or in any area of UAE. Evaluate your business strategy and financial capacity to secure a good investment in the country. Therefore, with its laws and regulations designed to be flexible and transparent in structure, investors should start capitalizing on these favorable attributes.