Is your successful operating business currently exposed to unnecessary liability? Are you maximizing the tax efficiency opportunities introduced by the UAE’s new Corporate Tax regime? Transitioning your existing standalone company into a subsidiary under a UAE Holding Company is one of the most powerful strategic moves you can make. This guide demystifies the restructuring process, ensuring your assets are protected and your tax liabilities are optimized.

Why Restructure? The Power of the UAE Holding Model

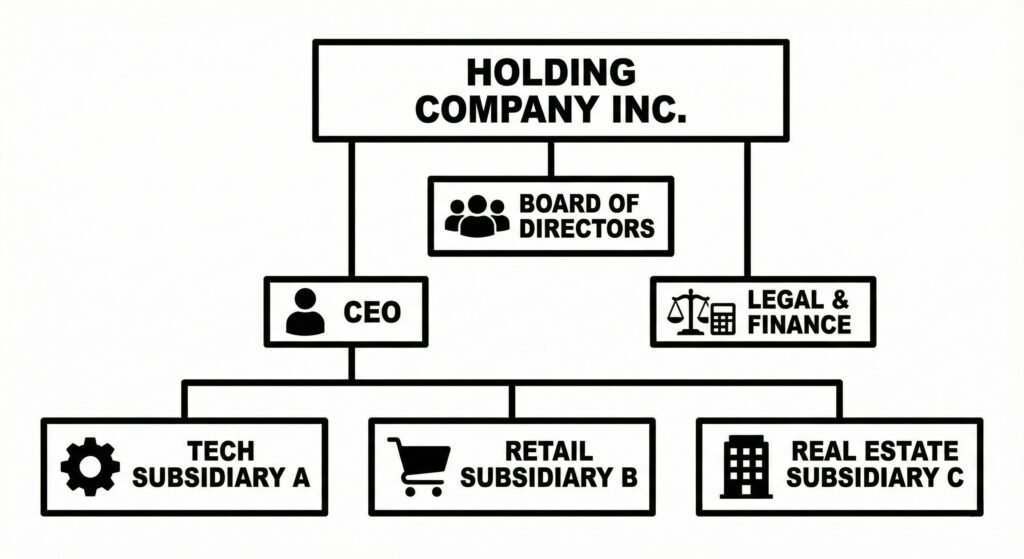

Before diving into the how, it is crucial to understand the why. A holding company does not produce goods or services; it holds assets—specifically, the shares of your operating business.

Key Benefits:

Risk Ring-Fencing: If your operating business faces a lawsuit or debt, the assets held in the Holding Company (like IP, real estate, or cash reserves) remain legally separate and protected.

Tax Optimization: Under the UAE Corporate Tax Law, dividends and capital gains earned by a holding company from qualifying subsidiaries can often be exempt from the 9% Corporate Tax (subject to the Participation Exemption rules).

Streamlined Succession: Transferring a single holding entity is often cleaner and cheaper than transferring multiple operating assets individually.

Step-by-Step: Transferring Ownership to a New Holding Company

Moving an “live” business under a holding company is technically a Share Transfer. You are effectively selling (or gifting) the shares of your current company to your new Holding Company.

Phase 1: Setup the UAE Holding Company (The Acquirer)

You cannot transfer shares to a ghost. First, you must incorporate the new entity that will act as the parent.

Choose Jurisdiction:

Mainland: Best if you plan to own varied onshore assets.

Free Zones (ADGM, DIFC, IFZA, DMCC): Preferred for international investors due to Common Law frameworks (in ADGM/DIFC) and 100% foreign ownership.

Activity Code: Ensure the license activity is strictly “Holding Company” or “Management of Subsidiaries.”

Phase 2: Valuation and Approvals

Since the Holding Company is a separate legal entity, the transfer of shares from you (the individual) to the HoldCo (the company) must be formalized.

Valuation: For unrelated parties, a valuation is required. However, for internal restructuring (where you own both entities), you can often transfer shares at par value, though you must document this clearly to satisfy Economic Substance Regulations (ESR) later.

Regulatory Approval: If your current business is regulated (e.g., by the Central Bank, KHDA, or DHA), you need a No Objection Certificate (NOC) before the transfer.

Phase 3: The Share Transfer Process

This is the core legal event.

Draft a Share Transfer Agreement: A legal contract stating that Person A transfers 100% of shares in Operating Company X to Holding Company Y.

Amend the MOA: The Memorandum of Association of your operating company must be updated to replace your name with the Holding Company’s name as the shareholder.

Notarization: In the UAE (especially Mainland), this requires signing before a notary public or using digital DED verification systems.

Expert Tip: Don’t forget the bank. Once the share transfer is complete, the Ultimate Beneficial Owner (UBO) remains you, but the direct shareholder changes. You must update your corporate bank KYC to avoid account freezing.

Corporate Tax & Compliance: What You Must Know

Transferring shares is a “taxable event” in many jurisdictions. In the UAE, you must navigate the new landscape carefully.

Capital Gains: Generally, if you sell your shares to the holding company, any “gain” might be taxable. However, restructuring relief is available if the transfer is done at book value for valid commercial reasons.

Participation Exemption: To ensure future dividends from your Operating Company to your Holding Company are tax-exempt, the HoldCo must own at least 5% of the subsidiary and hold it for at least 12 months.

Economic Substance: Your Holding Company cannot just be a “mailbox.” It must have a Board of Directors, hold meetings, and incur expenditure in the UAE to justify its existence.

Mainland vs. Free Zone: Where Should Your Holding Company Live?

Feature

Mainland

Free Zone

Ownership Scope

Can own Mainland & Free Zone assets easily.

Best for owning Free Zone or foreign assets.

Legal System

Civil Law.

Common Law (DIFC/ADGM) – often preferred by foreign investors.

Cost

Generally lower annual fees.

Higher setup and renewal costs.

Audit

Mandatory for most.

Mandatory and strictly enforced.

Frequently Asked Questions

Q: Can a UAE Holding Company own real estate?

Yes. A Mainland holding company can own property in designated freehold areas (and non-freehold if owned by GCC nationals). Free Zone holding companies generally own property only within their specific zone or designated freehold areas.

Q: How long does the share transfer take?

If all documents are ready, the government processing takes 5–10 working days. However, banking updates can take an additional 2–4 weeks.

Want to know more?

Contact us today! We specialize in helping entrepreneurs get their business and banking off the ground.