Deciding on the right jurisdiction for your holding company in the United Arab Emirates is one of the most critical strategic decisions you’ll make. The UAE offers a sophisticated landscape for corporate structuring, but two names consistently emerge at the forefront of the conversation: RAK International Corporate Centre (RAKICC) and the Jebel Ali Free Zone Authority (JAFZA).

Choosing between them isn’t a matter of which is “better,” but which is fundamentally right for your business objectives. One is a pure offshore haven designed for asset protection and international business, while the other is a global trade and logistics powerhouse offering operational substance.

This deep dive will dissect the RAKICC vs JAFZA holding company debate, giving you the clarity needed to structure your assets for maximum protection, efficiency, and growth.

What is a Holding Company and Why Do You Need One?

A holding company is a parent business entity—usually a corporation or LLC—that doesn’t manufacture anything, sell any products or services, or conduct any other business operations. Its primary purpose is to hold a controlling interest in the shares or assets of other companies, known as subsidiaries.

Businesses establish holding companies for several key reasons:

- Asset Protection: It shields the holding company’s assets from the debts and liabilities of its operating subsidiaries.

- Risk Management: It isolates risk. If one subsidiary fails, the others under the holding structure are not legally affected.

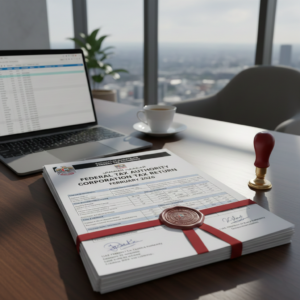

- Tax Optimization: It can centralize profits from various subsidiaries in a tax-efficient jurisdiction.

- Simplified Ownership & Transfer: It simplifies the process of buying and selling subsidiaries without disrupting the core ownership structure.

RAK International Corporate Centre (RAK ICC)

RAKICC is a corporate registry in the Emirate of Ras Al Khaimah. It is a premier jurisdiction for establishing offshore companies. An offshore company, by definition, is a legal entity registered in a jurisdiction where it does not conduct any substantial business activities. It’s a vehicle for international business and investment.

Key Benefits of a RAKICC Holding Company

- Cost-Effectiveness: RAKICC offers one of the most affordable setups and renewal fees for holding companies in the region.

- Ultimate Confidentiality: The details of company directors and shareholders are not publicly available, offering a high degree of privacy.

- 100% Foreign Ownership: No local sponsor or partner is required.

- Global Recognition: RAKICC structures are widely accepted by international banks and financial institutions.

- Asset Protection: It offers robust asset protection features, including the ability to migrate companies from other jurisdictions.

- Zero Tax: No corporate tax, income tax, or withholding tax on profits. (Note: This is subject to the new UAE Corporate Tax law, though many passive holding activities may have exemptions).

When is RAKICC the Right Choice?

RAKICC is the ideal choice for entities primarily focused on passive investment and asset management. Consider RAKICC if your main goal is:

- Holding shares in international or UAE-based companies.

- Owning real estate in Dubai or other approved areas.

- Managing a portfolio of intellectual property (trademarks, patents).

- Estate planning and wealth management.

- Acting as a Special Purpose Vehicle (SPV) for a single transaction.

Jebel Ali Free Zone Authority (JAFZA)

Established in 1985, JAFZA is one of the world’s largest and most prestigious free zones. It is an onshore jurisdiction, meaning it provides a physical and operational base within the UAE. While it offers holding company structures, it is fundamentally designed for trade, logistics, and industrial activities.

Key Benefits of a JAFZA Holding Company

- Operational Substance: A JAFZA company has a physical presence in the UAE, which is crucial for demonstrating economic substance and avoiding being labeled a “shell company.”

- Visa Eligibility: You can obtain UAE residence visas for shareholders, directors, and employees, allowing you to live and work in the UAE.

- Access to UAE Double Taxation Treaty (DTT) Network: A JAFZA company is considered a UAE “resident” company and can potentially benefit from the UAE’s extensive network of over 130 Double Taxation Avoidance treaties.

- Unmatched Prestige & Credibility: JAFZA is globally recognized as a premium business hub, lending significant credibility to your operations.

- Proximity to a Global Logistics Hub: Located next to the Jebel Ali Port and Al Maktoum International Airport, it’s an unparalleled hub for trade.

When is JAFZA the Right Choice?

JAFZA is the superior option when your holding company needs more than just a legal address. Choose JAFZA if you need to:

- Establish a regional headquarters (HQ) to manage subsidiaries.

- Hire staff and require UAE residence visas.

- Open a corporate bank account that requires clear operational substance.

- Leverage the UAE’s tax treaties for international dividend or royalty flows.

- Combine holding activities with operational functions like management, marketing, or administrative support for your subsidiaries.

Head-to-Head Comparison: RAKICC vs. JAFZA

Legal Status

Offshore (International Business Company)

Onshore (Free Zone Establishment – FZE/FZCO)

Physical Presence

Registered agent’s address only. No physical office required.

Must lease a physical office or desk space within the free zone.

Visa Eligibility

No visa eligibility.

Eligible to apply for UAE residence visas for staff and investors.

Confidentiality

High. Shareholder/director details are not public.

Moderate. Registry details are accessible to authorities.

Cost

Lower initial setup and annual renewal fees

Higher setup costs, plus mandatory annual office rent

Substance

Minimal substance requirements

Moderate (travel issues, visa delays)

DTAA Access

Cannot directly access the UAE’s DTAA network.

Can obtain a Tax Residency Certificate to benefit from DTTs.

Primary Use Care

Passive investment, asset holding, IP protection.

Active management, regional HQ, operational holding company.

Conclusion: Making the Right Decision

The choice between a RAKICC vs JAFZA holding company boils down to one word: purpose.

- Choose RAKICC if your primary goal is cost-effective, confidential, and passive asset holding without the need for a physical presence or visas in the UAE. It is the quintessential vehicle for international investors and wealth protection.

- Choose JAFZA if your holding company will serve as an active management hub, requiring a physical office, staff, residence visas, and access to the UAE’s tax treaty network. It is the choice for establishing a substantive regional headquarters with global credibility.

Ultimately, your corporate structure is the foundation of your business. Investing the time to choose the right jurisdiction will pay dividends in security, efficiency, and long-term success.

Ready to build your optimal UAE holding company structure? Contact our business registration experts today for a personalized consultation.